The smarter way to

manage credit risk

Portfolio Watch monitors portfolios of any size- giving a $50 million portfolio the same level of attention as a $2 billion portfolio.

Pricing is based on portfolio size and loan type, with C&I loans assessed at a slightly higher rate than commercial real estate due to differing credit risk. With Portfolio Watch, the tool can be “right-sized” to fit your unique needs.

Core Features

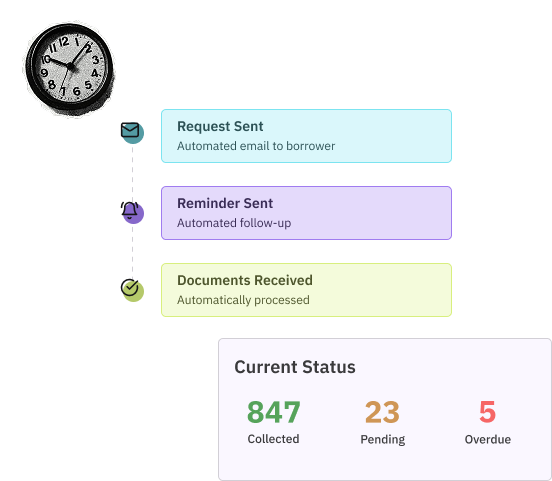

- Collects borrowers’ financial statements automatically

- Sends reminders and follows up to ensure timely submissions

- Reads financial statements and updates historic spreadsheet

- Analyzes financial spreadsheet and identifies trends

- Flags potential risks or emerging weaknesses in borrower performance

- Alerts lenders when action is required

- Ensures proactive borrower engagement before problems escalate

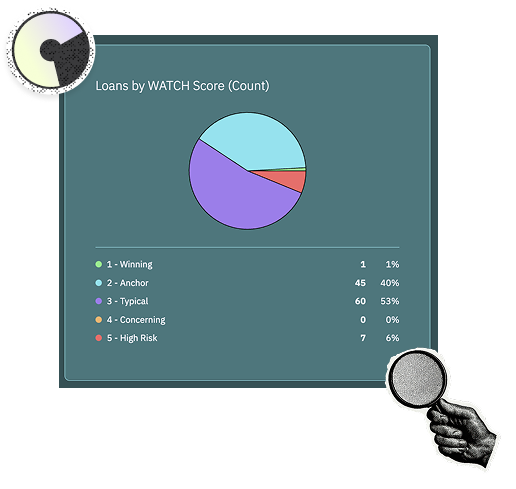

- Color-coded dashboard showing portfolio reporting status and risk levels

- Drill-down capability for flagged borrowers

- Allows lenders to see individual loan risk and trends at a glance

- Comment section for lenders to document follow-ups and notes on borrower weaknesses

- Management roll-up reporting to ensure timely action

- Annual review memos generated for lender review and approval

- Generates annual reports for regulatory purposes

- Provides oversight confirmation for management

- Dashboard visuals for real-time monitoring

- Bar charts or stats showing portfolio health and impact

- Reduces loan losses by 10–20%

- Potentially lowers required capital by up to 10%

- Frees lenders to focus on new loans by automating portfolio monitoring

- Supports consistent, proactive borrower management

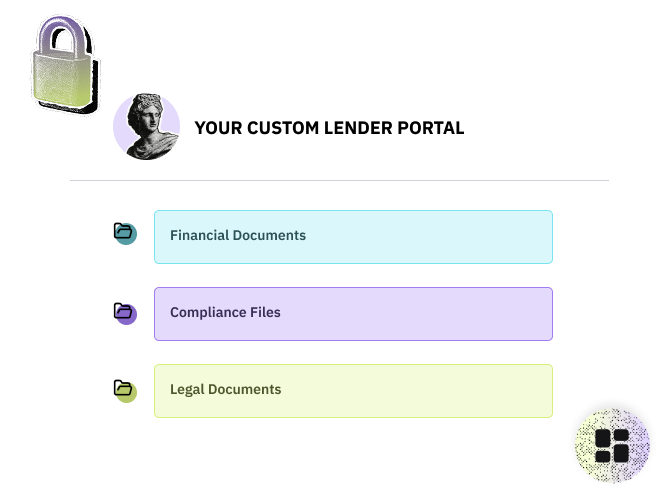

- Custom logo, brand colors, and domain for seamless borrower experience

- Secure document storage with role-based access control

- 100% white-labeled portal that reflects your brand identity

Core Features

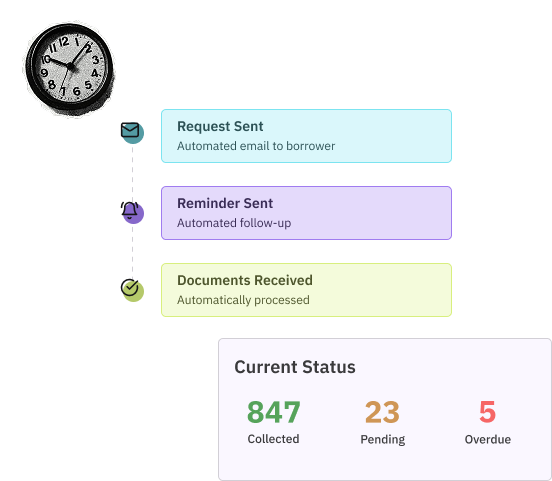

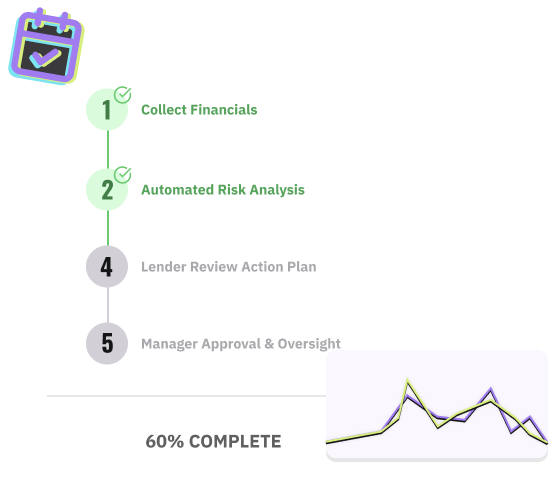

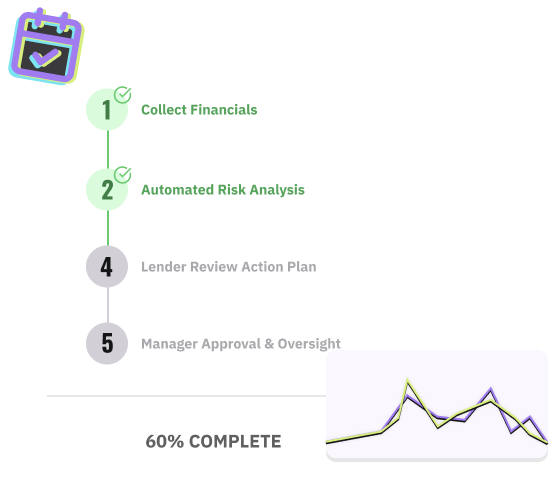

Automated Data Collection

- Collects borrowers’ financial statements automatically

- Sends reminders and follows up to ensure timely submissions

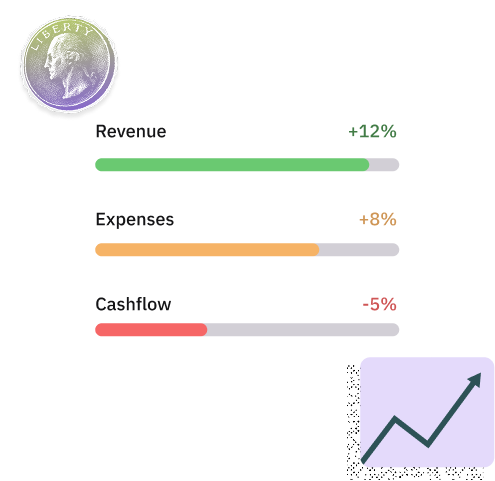

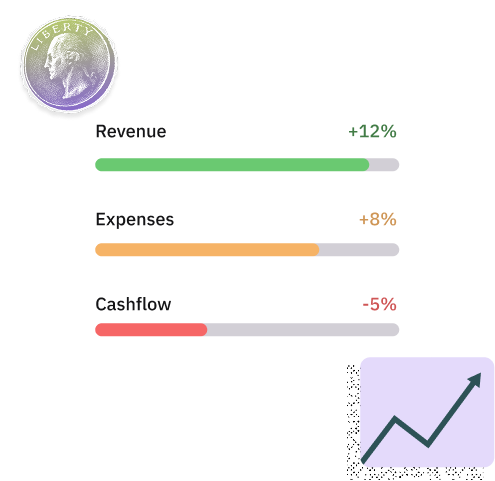

Financial Trend Analysis

- Reads financial statements and updates historic spreadsheet

- Analyzes financial spreadsheet and identifies trends

- Flags potential risks or emerging weaknesses in borrower performance

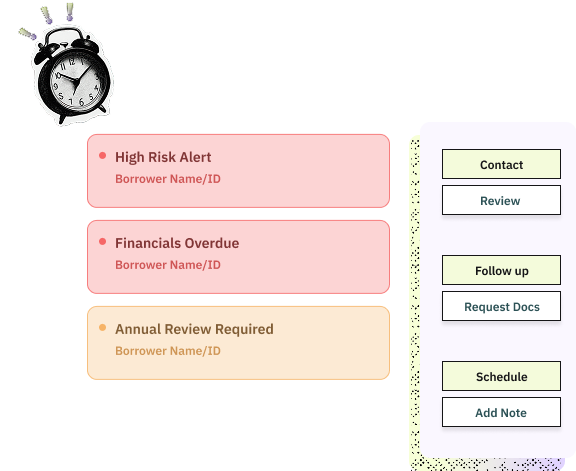

Risk Alert & Notifications

- Alerts lenders when action is required

- Ensures proactive borrower engagement before problems escalate

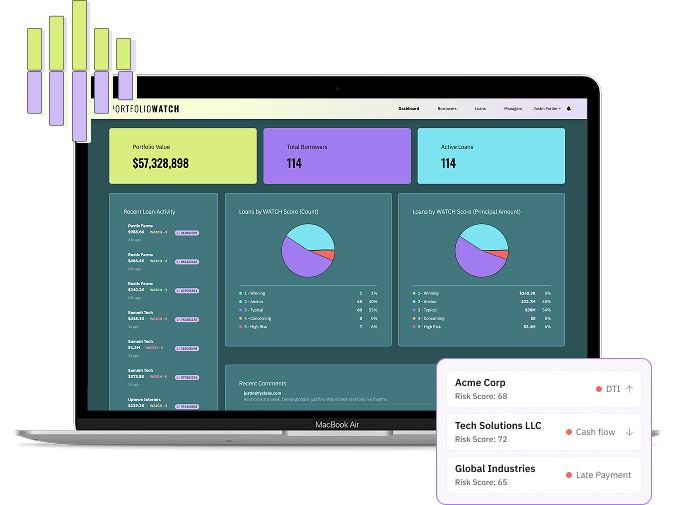

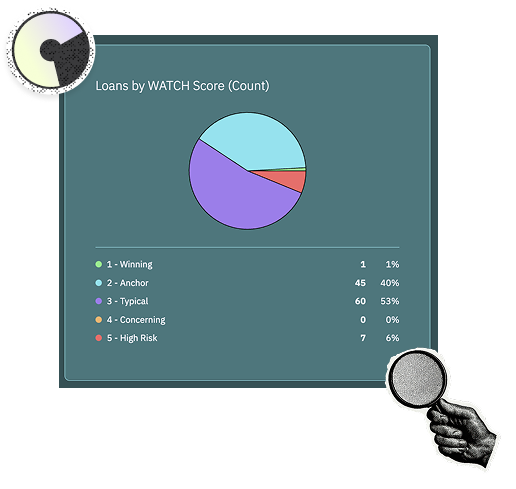

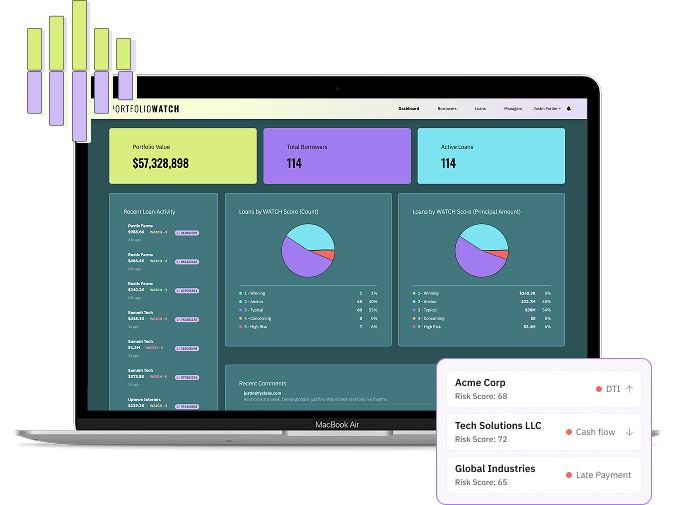

Dashboard & Portfolio Oversite

- Color-coded dashboard showing portfolio reporting status and risk levels

- Drill-down capability for flagged borrowers

- Allows lenders to see individual loan risk and trends at a glance

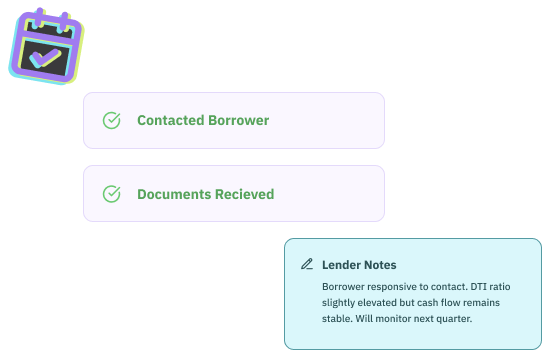

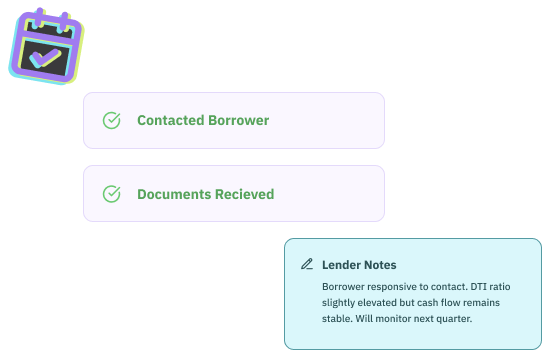

Documentation & Follow-up

- Comment section for lenders to document follow-ups and notes on borrower weaknesses

- Management roll-up reporting to ensure timely action

- Annual review memos generated for lender review and approval

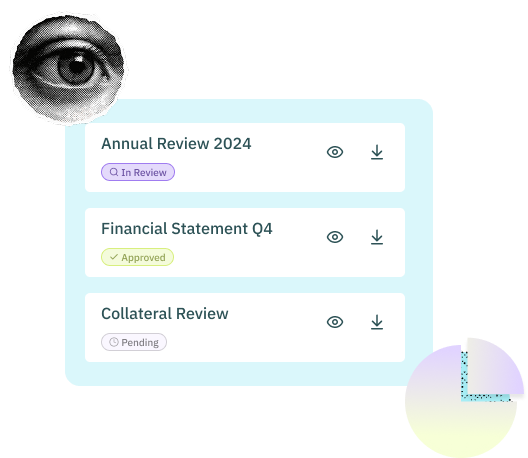

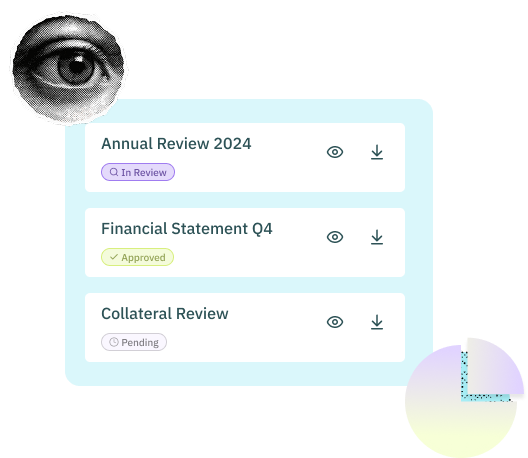

Reporting & Compliance Support

- Generates annual reports for regulatory purposes

- Provides oversight confirmation for management

Visual Insights & Analytics

- Dashboard visuals for real-time monitoring

- Bar charts or stats showing portfolio health and impact

Early Warning System (EWS) Impact

- Reduces loan losses by 10–20%

- Potentially lowers required capital by up to 10%

Easy Integration & Automation

- Frees lenders to focus on new loans by automating portfolio monitoring

- Supports consistent, proactive borrower management

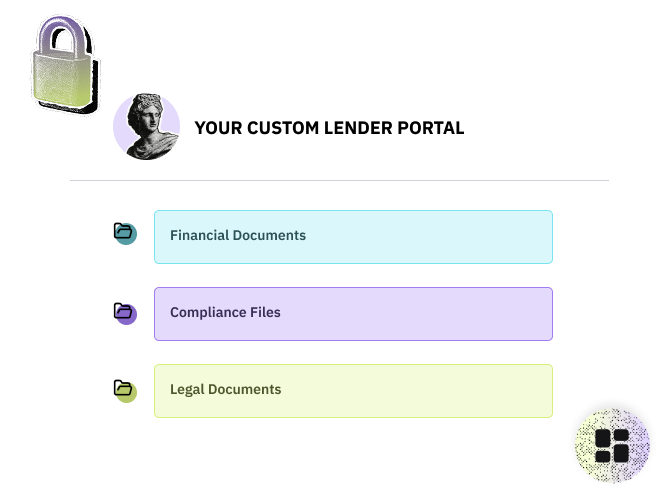

Lender Branded Borrower Data Rooms

- Custom logo, brand colors, and domain for seamless borrower experience

- Secure document storage with role-based access control

- 100% white-labeled portal that reflects your brand identity