The Future of

Credit Risk Management

Has Arrived

Why Lenders lose

When Risk

Is Misjudged

Is Misjudged

How a bank selects and manages its credit risk directly shapes its long-term stability and profitability. Every loan represents both opportunity and exposure, and when risk isn’t accurately assessed or managed, the consequences can be severe.

The Cost of

Checking Boxes

Checking Boxes

Effective credit risk management isn’t just about meeting regulations- it’s about safeguarding capital, allocating people and resources effectively, protecting relationships, and ensuring consistent performance through changing market cycles.

Failures That

Repeat

Repeat

Capital depletion from loan losses has historically been the leading cause of bank failures. Missed warning signs and delayed interventions leave lenders with fewer viable actions to address the situation, often forcing losses that could have been reduced or avoided.

Too Late

to Act

to Act

When warning signs are missed and action is delayed, lenders are left with fewer options. By the time problems surface, losses have often grown, weakening financial strength and damaging customer trust.

Early warnings and consistent reviews reduce surprises—and protect capital.

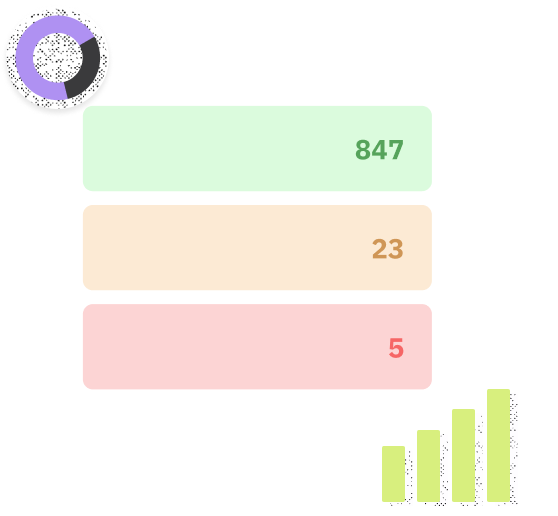

Meet Portfolio Watch

Portfolio Watch is an intelligent, automated tool that collects financial statements, analyzes trends, flags risks, and alerts lenders when action is needed. By automating portfolio oversight and generating annual review memos, it frees lenders to focus on new loans while ensuring consistent, proactive borrower monitoring.

TAKE A CLOSER LOOK

Real Insights, Clear Results

10-20%

Reduction in loan losses

Up to 10%

Lower Capital Requirements

85%

Prediction Accuracy

70bps

Average increase in ROE

Portfolio Watch

Development Timeline

Portfolio Watch is in active development and currently undergoing Alpha testing. Beta testing is expected for Q4 2025, with an official market launch planned for Q1 2026. Get ready to experience the next evolution in loan portfolio management!

1

2

3